Diploma students begin working earlier than degree students. Fee for registration of a firm of auditors.

CTC of form under Section 265.

. The fee is chargeable per exemption awarded. PERSONAL DATA PROTECTION ACT PDPA Sole ownership. Fees RM Cumulative Fees RM The first 50000.

In general professional fees are charged depending on the size of the company ie. Malaysia Company Incorporation Services. Company Limited By Guarantee under Section 24 Companies Act 1965.

Cumulative Fees RM subjected to 6 Service Tax. RM 300000 per company with standard statutory books. Fee income MYR Last Years fee income MYR Growth rate Fee split Year-end.

Authorised Capital RM 40000000. RM 10000000 to RM 20000000. A 274 were gazetted on 22 September 2020 to provide that for the purpose of payment of fees under Schedule 5 Appeals of the ITA the prescribed fees shall be as follows.

Revenue assets expenses. For 10-50 transactions per year the accounting fee is RM500 for 20-70 transactions per year the accounting fee is RM800 for 30-100 transactions per year the accounting fee is RM1000 for 50-150 transactions per year the accounting fee is RM1500 for 80-2000 transactions per year the accounting fee is RM2000 for 100-3000 transactions per year the accounting fee is RM3000. Minimum 2 Directors and 2Subscribers Standard MA.

Contribute to listianiana8diraya development by creating an account on GitHub. RM 84000 Approx Here the Tuition Fee of a Degree in Accounts from Malaysia will be approx of RM 70000 The RM 14000 of foundation course. Fees RM Cumulative Fees RM The first 50000.

The use of the word Accountant. RM 350000 - Professional Fee for. An exam entry fee must be paid for each exam you enter.

Fees RM Cumulative Fees RM Dormant Minimum audit fee 800 The first 50000. Foundation RM 9000 to RM 36500. The charges for our services usually depend on the size and complexity of your business.

In Malaysia the word Accountant is protected as provided for under the provisions of the Accountants Act 1967 which states that no one can hold himself out or practise as an Accountant unless he is registered as a member of the Malaysian Institute of Accountants. Negotiable but should not be less than. Liaising with auditors and tax authorities.

Tuition Fees for studying a degree course in Malaysia for Accounts. 47 47A Jalan Jati 2 Taman Nusa Bestari Jaya 79150 Iskandar Puteri Johor. Provide professional advice related to your business set up operation and Malaysia rules compliance include company incorporation accounting payroll and etc.

Diploma RM 15000 to RM 45000. This allows them to start their career early compared with degree students who will take an additional 2 to 3 years before embarking on their career. Lodgement of form under Section 265.

Grant Thornton 1 760. An exemption fee is charged for each ACCA exam you are awarded exemption from. Registration of a new LLP or for the conversion into an LLP.

Accounting diplomas cost RM24000 on average. At 3E Accounting we dont believe in a one-size-fits-all package for our clients. All companies incorporated in Malaysia must have their accounts audited by an approved and qualified auditor as mandated by the Companies Act of 2016.

You also save more in tuition fees compared with degree students who pay up to RM100000. Total departmental outsourcing for accounting and finance functions. Masters degree RM 8000 to RM 50000.

Please find herewith an example of our bookkeeping fee for a small scale business for your reference. Dormant Minimum audit fee 800 The first 50000. As a general estimate the cost of studying Account and Finance in Malaysia as per the level of course are as follows.

Start a Malaysia Company. 1000 for every RM1000000 increase of a fraction thereof up to RM20000000. The Income Tax Prescribed Fees under Schedule 5 to the Act Rules 2020 PU.

Fees RM subjected to 6 Service Tax. Fees RM Cumulative Fees RM The first 50000. The fee is chargeable per exemption awarded.

The Malaysian Institute of. Typically a startup company would incur between RM1000-RM1500 as the tax fee. Bachelors degree RM 6500 to RM 150000.

RM 200000 - Professional Fee for Sdn Bhd.

Eft Nedir Nasil Yapilir Blog Seyahat Para

Accounting Course In Malaysia Eduadvisor

Acca Courses In Malaysia Top Accounting Uni Colleges 2022

Pin By S F Consulting Firm Limited On Company Registration Fee In Malaysia Company Registration Business Names

Top Ten Universities In Uk For Accounting And Finance New Ranking Uk Universities University Guide University

Download Student Fee Collection System Excel Template Exceldatapro School Report Card Lesson Planner Excel Templates

Hello Admin Of Cashcamel L M Member Phenghc And This Is My Latest Payment Proof Thank You Very Much Business Contact Payment Merchant Services

Sales And Service Tax Training In Ipoh Hrdf Claimable Vanue Aks Training Centre Ipoh Date 16 08 2018 Time 9 Training Center Ipoh Goods And Services

Bbva Bank Statement Template Mbcvirtual Statement Template Bank Statement Templates

Accounting Course In Malaysia Eduadvisor

Stock Investment Guide Infographic Investing Finances Money Trading

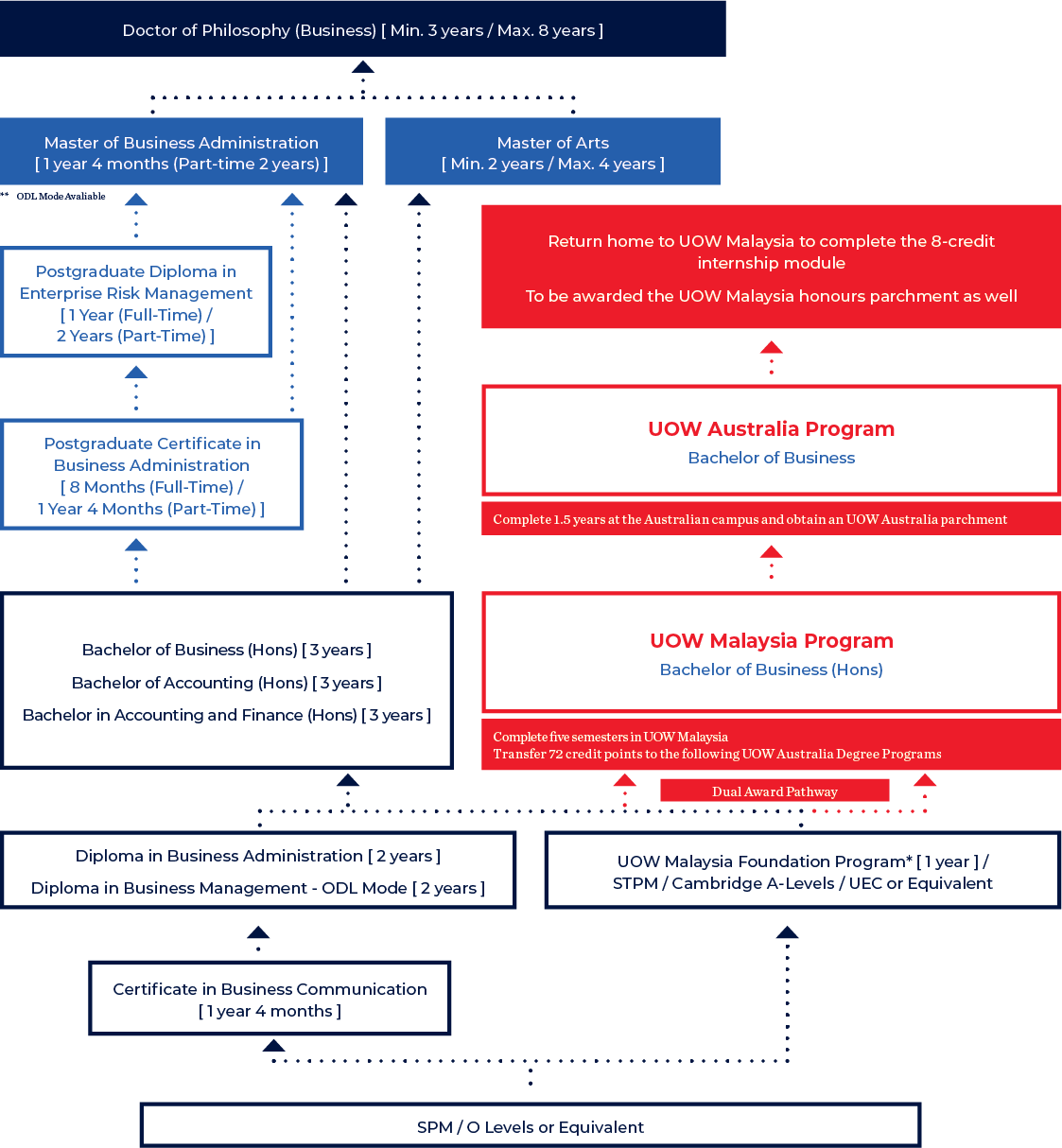

Bachelor Of Accounting Hons Welcome To Uow Malaysia Kdu

Building Contractor Appointment Letter How To Create A Building Contractor Appointment Letter Download This Building C Lettering Letter Templates Templates

Accounting Course In Malaysia Eduadvisor

Welcome To Biztory Cloud Accounting Software Malaysia Online Web Based Small Business Gst Compliant Cloud Accounting Accounting Software Accounting